I want to shed light on the best small businesses to buy or sell and to unveil which businesses are the worst. To ascertain which industries were safest versus worst I studied the default rates of SBA 7(a) loans made between 2010-2019. This dataset included 545,751 businesses funded by banks nationwide using the SBA 7(a) loan program. Based upon the results of my study I noted that some industries had significantly lower default rates than others.

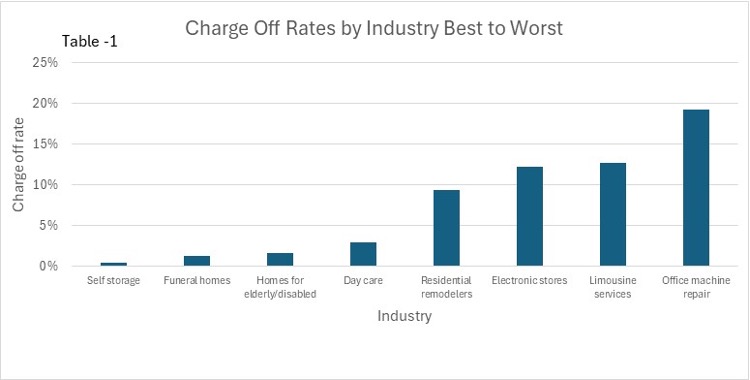

The best industries tend to have a significant real estate component in which the real estate is fundamentally a major part of the business. Examples of real estate centric businesses that have low risk are facilities for people with disabilities and the elderly (1.6%), funeral homes (1.26%), lessors of self-storage units (.45%), and child day care services (2.88%). The ten-year SBA 7(a) loan charge off rates in these industries ranged from .45% to 2.88%. This means businesses within these industries were successful over 97% of the time over the ten-year period studied.

Turning our attention to the worst businesses based upon the same SBA 7(a) loan charge off data. Among the worst businesses were computer and office machine repair shops (19.31%), electronics stores (12.26%), limousine services (12.73%), clothing stores (~10%), and residential remodelers (9.40%). The first few industries mentioned have succumbed to technological advances. For example computer repair stores are unnecessary as the price of computers has fallen so drastically the public is not likely to spend money on repairs. Electronics stores, clothing stores, and other brick and mortar retailers have been replaced by online shopping. The demise of limousine services is likely due in part to Uber and Lyft. The charge off rate for the worst industries ranged from 9.40% for residential remodelers to almost ~20% for computer and office machine repair (see table 1).

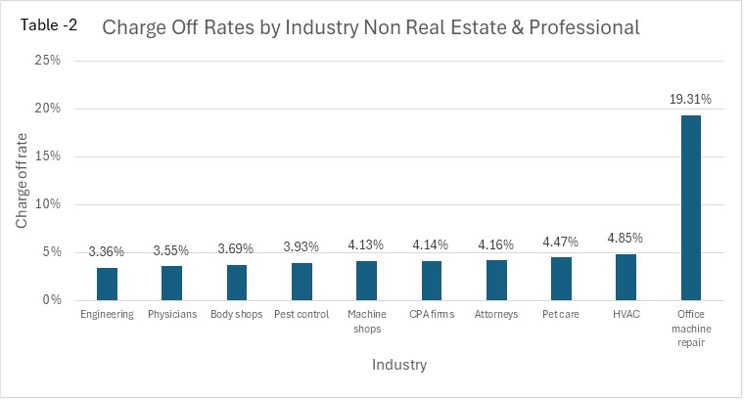

If you are interested in buying a non-real estate centric business in a safe industry consider the following: exterminating and pest control services (3.93%), customer computer programming (4.01%), pet care (4.47%) (except veterinary services), automotive body, paint, and interior repair and maintenance “Body Shop” (3.69%), plumbing, heating and air conditioning contractors “HVAC” (4.85%), and machine shops (4.13%). Based upon SBA 7(a) loan information businesses within these industries had a better than ninety five percent (95%) success rate during the ten-year period examined.

If you are a professional service provider i.e., physician (other than mental health providers) (3.55%), attorney (4.16%), CPA (4.14%), engineer services (3.36%), etc. then you would do well to buy a business within your discipline as charge off rates among these industries are low. The ten-year success rate for these industries is greater than 95% (see table – 2).

While computer repair and certain retail industries were very risky hosiery and sock mills, and sheer hosiery mills were the worst businesses with a default rate of 100%. On the other hand tortilla manufacturing, skiing facilities, securities brokerage, farming, water transportation, and ice manufacturing were among the best industries with a 0% default rate.

Selecting the best industries does not ensure that you will not struggle with the purchase of a particular business within a particular industry. It simply provides you with the foreknowledge that you have a greater chance of success. All small business endeavors require a great deal of fortitude and perseverance by the owner. I tend to think that even in somewhat risky industries there are opportunities to be found as you might be able to purchase these businesses at lower multiples of cash flow than a safer business. However, if you can purchase a business in a safe industry, at a reasonable price (i.e., lower multiple of cash flow) that makes the most sense to me.