I want to shed light on the SBA 7 (a) option for buying or selling a business. The SBA does not loan money, instead they guarantee the loans that participating lenders make. Most banks have an SBA division, so your local bank likely participates in this government guaranteed loan program. One of the most appealing aspects of the 7 a program is that the buyer can buy a business for as little as 2.5% down. This makes buying a business affordable for most people including employees of a business.

To illustrate this point, let me give you an example of how SBA 7(a) loans can an employee or investor buy a business with cooperation from a seller and 2.5%, or in some cases 0% down.

Let’s say you want to buy a business that is worth $1 million and has a net income of $300,000 per year. The seller is willing to carry a 7.5% note, which is 7.5% of the total project, or $75,000. The note requires interest only payments or full standby for 2 years, followed by a full amortization of that loan (no balloon allowed) over a 5-year term. The interest rate on the note is assumed to be 8%. You can get an SBA 7(a) loan for 90% of the purchase price, or $900,000, with an 11.25% quarterly adjustable interest rate and a 10-year term. Your down payment would be 2.5% of the purchase price, or $25,000, which would be your cash to the table.

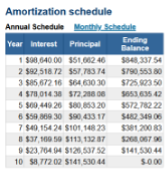

Your monthly payment for the SBA 7(a) loan would be $12,525.21, or $150,302.46 per year. Your annual interest payment for the seller note would be $6,000 for the first two years, and then $18,000 for the remaining 5 years. Your total annual debt service would be $156,302.46 for the first two years, and $168,302.46 for the remaining 5 years.

Your annual cash flow after debt service would be $143,697.54 for the first two years, and $131,697.54 for the remaining 5 years. Your cash-on-cash return would be 574.8% for the first two years, and 526.8% for the remaining 5 years. This is a much higher return than if you had invested your $25,000 in a savings account, a stock market index fund, or even a hedge fund.

As you can see, SBA 7(a) loans can help you buy or sell a business with a low-down payment, a long repayment term, a competitive interest rate, and a flexible use of funds. Contact me If you want to know more about the SBA 7(a) program, business valuation, or buying or selling a business.